EXAMPLES

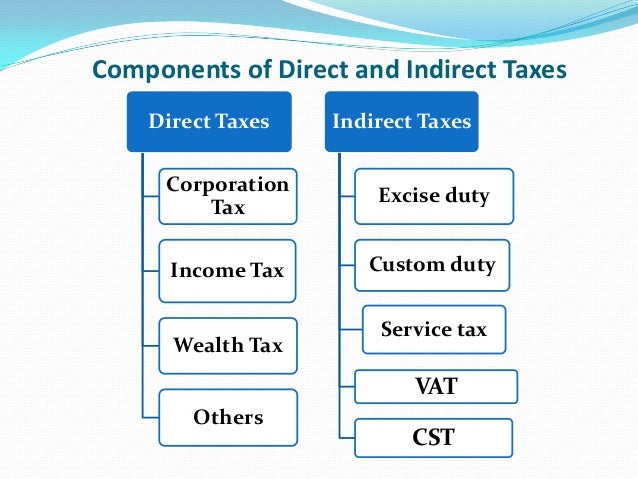

Examples of Direct Taxes:

These are some of the direct taxes that you pay

1. Income Tax:

This is one of the most well-known and least understood taxes. It is the tax that is levied on your earning in a financial year. There are many facets to income tax, such as the tax slabs, taxable income, tax deducted at source (TDS), reduction of taxable income, etc. The tax is applicable to both individuals and companies. For individuals, the tax that they have to pay depends on which tax bracket they fall in. This bracket or slab determines the tax to be paid based on the annual income of the assessee and ranges from no tax to 30% tax for the high income groups.

Examples of Indirect Taxes:

These are some of the common indirect taxes that you pay.

- Sales Tax:As the name suggests, sales tax is a tax that is levied on the sale of a product. This product can be something that was produced in India or imported and can even cover services rendered. This tax is levied on the seller of the product who then transfers it onto the person who buys said product with the sales tax added to the price of the product. The limitation of this tax is that it can be levied only ones for a particular product, which means that if the product is sold a second time, sales tax cannot be applied to it.

Comments